Community Choice Energy-HB’s Enron

“The story of Enron, the energy company, and its rise and inglorious fall. We see its origins in the 1980s, how it was set up with energy deregulation in mind, and how it profited off the deregulation. Moreover, we see how it took accounting practices to the extremes, to the point that the senior executives were cooking the books. There is also coverage of the unethical practices of Enron’ traders, particularly in the California electricity market. In the end it all comes crashing down, losing everyday, law-abiding employees their jobs, savings and pensions.”

Once again the disaster that is Community Choice Aggregation (or Energy) rears its head in Huntington Beach, now in the form of an “invite” from Irvine to join a co-op of cities forming a new and expensive bureaucracy called a JPA* (Joint Powers Authority).

CCA was first brought to our city council in 2017*. During that time a compelling case was made that implementation would end in financial disaster for HB. CCA was scrapped because of that effort. 2 years later the truth of CCA is worse, not better.

While this issue of CCA is complex it boils down to these points:

- The City Council will set your power rates. Your rates can be increased with no oversight and whenever the city wants more of your money. CCAs bypass statutory requirements for pricing approval.

- The customer has no choice with CCA.

- Renewable energy costs will rise when state and federal subsidies are taken away.

- Despite claims to the contrary CCA customers cannot directly buy renewable power.

- CCA will create an very expensive new bureaucracy with pensions for all employees. City of HB currently has over $1 billion in unfunded liabilities, CCA will make that crisis worse.

- CCA creates conflicts of interest between politicians, city employees, consultants and energy retailers.

- The State of California has mandated use of renewable energy. There is no need to take this risk locally.

- If the City Council guesses poorly signing long-term energy contracts the CCA could bankrupt the city.

Viewed through the prism of Risk Management CCA’s dangers far outweigh the benefits. No issue ever before council has the destructive possibilities that Community Choice Energy does. CCA is an Enron-Level disaster in the making.

As CCA is technical and complex, that’s how they hide the truth, it requires a deep dive to understand exactly how the sausage is made and our money is stolen. Read on for the details.

Sometimes bad ideas die, killed by the weight of their misconceptions. But sometimes bad ideas thrive by hope, platitudes, greed and outright lies.

That is Community Choice Aggregation (Energy).

Lets review the talking points and uncover the underlying truth.

What is Community Choice Aggregation?

Here’s how it works. Local government agencies form a new, semi-invisible government agency to purchase and sell electricity. The local utility company, such as SCE, provides transmission, distribution and customer billing services for a fee paid by the new agency’s customers. All people who live and do business in the area become customers of the new agency unless they ask to “opt out.”

Lets begin with the lynchpin of CCA-Energy Subsidies. “A sum of money granted by the government or a public body to assist an industry or business so that the price of a commodity or service may remain low or competitive”

“There is no doubt that (these) subsidies incentivize renewables, but what do they do to the cost of the electricity generated by them? They actually increase the cost. However, this cost is transferred from the ratepayer to the taxpayer, and so goes unnoticed by most Americans. Using the per-kWh subsidy numbers from EIA and UT in the figure above, each kWh of solar produced in 2010 received 88¢, more than ten times the actual cost of any other energy source. These subsidies have to be added to the retail cost of that energy to determine total costs since that’s what was actually spent to produce it.

So in 2010 and 2011, solar cost about 100¢ per kWh, and in 2013 and 2014, solar cost about 80¢ per kWh.

For comparison, nuclear energy cost between 4¢ and 5¢ per kWh to produce over this time period. Remember, though, the cost to produce energy is not the same as the price charged for it. Price is set by the region and the market, and has add-ons for transmission, grid maintenance and other non-production costs. Subsidies decrease the price while increasing the cost.”

1) Because renewable energy is always more expensive* than “system power” (fossil power sold through CAISO daily markets and hour-ahead markets) CCA’s ability to offer competitive energy is solely dependent on taxpayer subsidies. These subsidies are now on the chopping block. “The Trump administration is again seeking severe cuts to the U.S. Energy Department division charged with renewable energy and energy efficiency research, according to a department official familiar with the plan. The official, who spoke on the condition of anonymity, said the Office of Energy Efficiency and Renewable Energy would see its $2.3 billion budget slashed by about 70 percent, to $700 million, under President Donald Trump’s fiscal 2020 budget request.” “Without that cash infusion, the wind and solar industries will need to become even more efficient, competing with energy sources such as natural gas and nuclear that will continue to receive federal subsidies. Under federal tax law, oil and natural gas drillers are singled out for lucrative deductions based on the amount of energy they produce. And nuclear power plants receive a long list of federal benefits, including a $500 million cap on liability in the event of a meltdown.”

Choice. Proponents of CCA say “consumers want choice”

1) The customer has no “choice” under CCA. The city council or JPA makes all energy purchases. All of SCE’s former customers are forced to become the CCA’s customers and must “Opt-Out” if they want remain an SCE customer. If CCA is such a good deal why are customers automatically enlisted? because the consultants that implement CCAs realized a much higher retention rate when they do. If given an actual choice and the facts people do not willingly choose CCA.

Cost. Proponents say “ratepayers bills will go down”

1) When I began researching CCA four years ago I attended or watched over a dozen presentations including the meeting at our main library on March 20th, 2017. At the time all of the presentations quoted that ratepayers could “possibly receive 5% savings through CCA”. Now, CCAs are claiming possible savings of 2%. That’s a 3% drop in the promoted, not actual, savings in just 2 years. The CCA pricing propaganda is going in the wrong direction.

2) CCAs claim that they will buy power “more competitively” than SCE or other IOUs. This is impossible as SCE’s scale is massive compared to any particular city or JPA and thus cities will always have less buying power, not more than the SCE. The proposed Irvine group would encompass Irvine, Costa Mesa, Huntington Beach, Newport Beach and Tustin; of which the combined population is 763,182. SCE’s coverage area has a population of 20,549,812. To put that in perspective the proposed Irvine joint CCA would be just 3.71% of SCE’s coverage area…Kern County alone has more people than all of the proposed Irvine CCA combined. It’s like your corner grocer claiming he can sell Corona cheaper than Costco…economies of scale and common sense tell us that cannot be true.

3) How exactly do CCAs offer lower rates than IOUs? SCE, PG&E and SDG&E must go before the PUC’s Energy Resource Recovery Account (ERRA) and General Rate Case (GRC) and disclose their future pricing. CCAs get to sit there and take note. Then they price their power fractionally less than the IOUs. It’s like having to disclose your cards at poker but the other guy doesn’t. This way CCAs can always appear competitive. https://www.cpuc.ca.gov/Costs_Rates/s

4) You’re never free from SCE. CA energy regulators increased the fees (PCIA-Power Charge Indifference Adjustment, the charge that SCE levies for every customer lost to CCA) by 1.68%, topping 5% overall. This comes directly out of any proposed “savings” CCAs might offer. From the Newport Beach Independent: “Laguna Beach decided not to participate in the proposed clean energy authority, partly because of a recent ruling by the California Public Utilities Commissions that allows investor-owned utilities to recover costs (PCIA) from customers leaving their system, Shohreh Dupuis, assistant city manager and director of public works said in a statement to the Daily Pilot.”. We strongly suspect that the Irvine CCA is being rushed right now because of the PCIA increase. Quote from Dawn Weisz, Marin Clean Energy CEO March 20th, 2017 “We must make SCE whole (with PCIA), we have no idea what that costs, SCE working on model now, biggest unknown for CCA”

5) Recently a former energy executive with deep knowledge of CCA reviewed Irvine’s feasibility study and found that, at best, a $.88 per month savings for the average household.

6) Startup costs. $10 million for HB alone.

7) During the CCA meeting held at HB’s main library on March 20th, 2017 Lancaster junior city manager Jason Caudle (current CEO of the Lancaster Ca Choice Energy Authority) said “you can’t do it cheaper and greener than SCE, We have not seen cheaper energy”

Green Energy Fraud. Proponents of CCA say “you will be able to buy Green Energy”

1) CCAs purchase fossil fuel energy and sell it as “green” by a process known as “Greenwashing”. Greenwashing happens when a renewable energy provider like a solar farm, which receives massive taxpayer subsidies, produces energy. When 1 megawatt of clean energy is produced the solar farm operator can issue a REC (renewable energy certificate), they can then sell the REC to a CCA which purchases fossil fuel energy and applies the REC to the purchase, thereby “greenwashing” that megawatt of power allowing the CCA to call it “renewable”, or “green” energy. Think of RECs as a taxpayer subsidized “discount coupon” allowing CCAs to purchase cheap fossil fuel and fraudulently pass it off to ratepayers as “Green” energy. The RECs game, and the profits derived from misleading consumers, is over with the implementation of AB 1110 in late 2019.

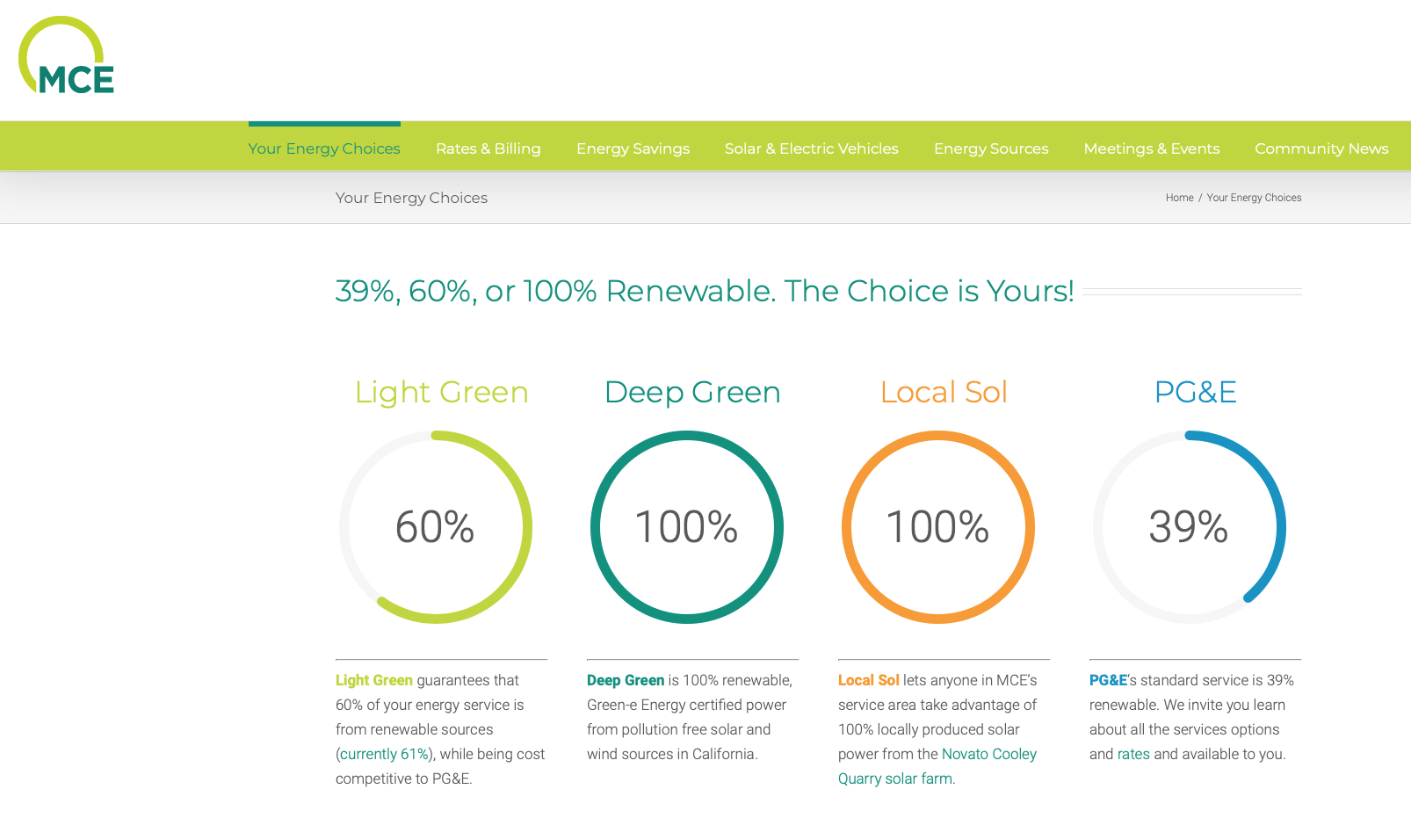

2) Because of the physical reality of the grid the consumer cannot *buy* green, or renewable, energy. Our grid system delivers power to customers, it wouldn’t know what energy is green or otherwise. All CCAs claim that consumers can, in fact, directly buy renewable power through the CCA and they even sell tiered plans where the consumer is offered increased amounts of “green energy” if they pay more (see image at the top). This is fraud. There is no way to take power produced from a renewable source and separate it from the power produced by SCE and send it to a customer. “When electricity is generated—either from a renewable or non-renewable power plant—the electrons added to the grid are indistinguishable”. NREL

3) Because they are always subsidized by the taxpayers renewables are always more costly and when subsidies are decreased or removed will massively increase consumer costs. The concept and pricing are a scam and will only continue to be viable as long as renewable energy is subsidized. After that the game is over and taxpayers will be stuck with wildly escalating energy bills.

4) The state of California already mandates the use of renewables, fully 50% of the state’s energy must come from renewables by 2030. Because of this there is no need to take the risk of CCA.

Accountability and Potential Misuse.

1) IOUs must go before the Public Utility Commission (PUC) to ask for rate increases. CCAs are under no such burden, a rate increase can be made at the whim of a city council or the JPA.

2) Every time the city needs an infusion of cash the urge to raise energy rates will be irresistible for unprincipled leaders. In a city with 200k residents and 1000s of commercial ratepayers raising their rates even 1% would result in massive revenue increases. To politicians who are constrained by the fiscal realities of CA this ability will be like catnip. It is a tool that should never be in the hands of politicians.

3) Joint Powers Authority. A JPA is simply a legal formation allowing cities to collude on CCA. The JPA will be populated with council people.

4) No actual choice. Although billed, literally, as “choice” the customer’s only possible decision is whether they stay or exit the CCA.

SCE.

1) Power Generation is the riskiest part of the retail energy business due to fuel and maintenance costs. IOUs want out of the generation business. CCA gives SCE a way to get out of long-term contracts. Then SCE charges CCAs for energy transport and billing and keeps all customers on the hook with monthly PCIA fees. With CCA SCE literally has their cake and eats it all up.

New Bureaucracy and Fiscal Danger.

1) CCAs will create a massive new bureaucracy with new upfront costs ($10 million), pensions and ongoing liabilities. And, because no one in local government has any experience buying power in the energy markets any choices they make could have disastrous consequences for the taxpayers of HB. CCAs will sign long-term energy contracts that will be irrevocable. If cities guess wrong they will fiscally encumber their towns, at a time that all CA cities are scrambling to increase revenue and decrease costs. Implementation of CCA could be catastrophic. Think Enron.

2) Irvine CCA will be in precarious financial situation because CPUC (Rulemaking 18-07-003: “DECISION ON 2019 RENEWABLES PORTFOLIO STANDARD PROCUREMENT PLANS”) upholds SB350, which requires all energy providers to have executed long-term contracts for their renewable energy. This means that Irvine, like all CCAs, will (i) need tens of millions of dollars as collateral to execute these energy contracts… or (ii) Irvine will keep this liability secret while launching its CCA, and then escalate its retail electricity prices to attempt to raise tens of millions of dollars to fund its looming contract liability. The consultants operating Irvine’s CCA will likely tell few, if any City of Irvine staffers about this (assuming they know), and will attempt to push Irvine into figuring out how to make things work down the road, after the Irvine CCA launches. Unlike MCE and SCP, which have on hand $217 MM and $60 MM in cash & securities, respectively, and have already executed much of their req’d long term energy contracts, this is not a smart time to be launching a new CCA because new CCAs don’t have the requisite financial strength to execute long-term energy contracts. As things progress, the consultants will be taking their fee money from Irvine while claiming the financial calamity was beyond their knowledge.

3) The danger of a city or JPA’s insolvency because of starting and running a CCA cannot be overstated. CCAs sales points are false, startup costs are huge, bureaucracies are increased and ratepayers are put in fiscal and actual danger from the implementation of CCA.

4) Looking over Irvine’s feasibility study it appears to rely heavily on existing CCAs (Marin Clean Energy et al…) cash on hand. From energy expert Jim Phelps: “… the early CCAs all benefitted from massive use and abuse of RECs. RECs allowed early CCAs to sell “clean” energy that was little more than inexpensive system power (fossil power sold through CAISO daily markets and hour-ahead markets) plus a certificate. CCAs then benchmarked their prices against PG&E’s (high) prices, and sold this clean energy at a premium to consumers. In other words, NorCal CCAs sold high-profit-margin “REC clean energy” against an incumbent utility whose prices were high, and in the process banked millions of dollars.”

4) The unbundled RECs game, and the profits derived from misleading consumers, is over with the implementation of AB1110 (Greenhouse gases emissions intensity reporting) in late 2019.

5) Jim Phelps “The schism between old CCAs and new CCAs – the haves and the have nots – is seen by many in the energy industry. We all believe that newer CCAs will fail financially, while older CCAs with large cash holdings survive — these guys are getting credit ratings as they prepare to float bonds. That ~$47 million reserve fund that Irvine’s consultant shows in its pro-forma table for CCA is… fiction. Cities may have a “financial firewall” that insulates them from PPA (Power Purchase Agreement) liabilities, but they will STILL incur on-going costs for bonds, Feed-in Tariffs, etc. Failures will be messy & expensive for cities.”

Physical Danger.

1) Ratepayers enjoy stable electricity with IOUs like SCE. Recent intentional blackout events highlight the danger of the CA government involving themselves in the energy business, with disastrous results. CA is in the grip of environmental regulatory insanity forcing costs to skyrocket and reliability to plummet. CCAs are the local extension of those regulatory overreaches. Ask any of the 800,000 PG&E customers who recently had their lights turned out how they feel about energy reliability.

2) Our grid was not designed to handle renewables. Renewables like solar power overload the grid with energy that must sometimes be offloaded to other states or risk overload. This puts great stress on the CA grid.

3) “Besides having the most expensive electricity west of the Mississippi River in the continental U.S., California already has the least reliable electricity,” Forbes reported. “California easily leads the nation with nearly 470 power outages a year, compared to 160 for second place Texas, which is really amazing because Texas produces 125% MORE electricity! (here).”

“California’s reliability problems will be multiplied as more wind and solar enter the power mix, intermittent resources located in remote areas that cannot be so easily transported to cities via the grid.”

Conflicts of Interest.

1) Irvine’s CCA feasibility study was performed by EES Consulting. From EES’ CCA page “EES Consulting, Inc. (EES) is currently providing technical energy consulting services such as feasibility assessment, feasibility peer review services, and implementation and launch services to numerous CCA initiatives in California”. So the company tasked with giving a non-biased opinion on whether the CCA would be viable is also the company that would likely run and operate it and be involved in energy purchases profiting handsomely from the commissions received. What is the likelihood that EES would recommend denial of the potential CCA ? Zero.

2) During the CCA debate held at HB city hall on 2017 the advocate was Howard Choi, (Board Chair/General Manager, Office of Sustainability, County of Los Angeles) Mr. Choi left soon after for consultancy job at EES.

In conclusion, The HB City Council would be locking our town into a program based on taxpayer-funded subsidies, and massive accounting tricks; in that way CCA is more akin to a Ponzi scheme than an energy program. Government takes taxpayer money to subsidize renewables then mandates program that REQUIRE those same renewables. When (not if) subsidies for renewables are stopped energy prices will naturally skyrocket.

Huntington Beach City Council members were elected to lead, to look deeply into the issues that affect its citizens and make the most informed decisions possible.

Email the City Council and tell them NO ON CCA !!

*JPA definition:

A joint powers authority (JPA) is an entity permitted under the laws of some U.S. states, whereby two or more public authorities (e.g. local governments, or utility or transport districts), not necessarily located in the same state, may jointly exercise any power common to all of them. Joint powers authorities may be used where an activity naturally transcends the boundaries of existing public authorities. An example would be the Transbay Joint Powers Authority, set up to promote the construction of a new transit center in San Francisco, with several transportation boards and counties around the San Francisco Bay Area as members; by combining their commercial efforts, public authorities can achieve economies of scale or market power.

Joint powers authorities are particularly widely used in California (where they are permitted under Section 6502 of the State Government Code.

A joint powers authority is distinct from the member authorities; they have separate operating boards of directors. These boards can be given any of the powers inherent in all of the participating agencies. The authorizing agreement states the powers the new authority will be allowed to exercise. The term, membership, and standing orders of the board of the authority must also be specified. The joint authority may employ staff and establish policies independently of the constituent authorities.

Joint powers authorities receive existing powers from the creating governments; thus, they are distinct from special districts, which receive new delegations of sovereign power from the state.

HB CCA debate 2017

Cost of renewables.

Renewable energy failures:

1) Georgetown TX: “The city had pinned its hopes on wind and solar when it started negotiating 20-year and 25-year contracts with two wind farms and a solar facility that required the city to purchase far more energy than it could immediately use. The original idea in 2012 was to sell that surplus and recoup the costs while maintaining stability for the city’s power needs. But market volatility and decreased demand for electricity meant that losses piled up, leaving the municipally owned electric utility facing a shortfall of almost $7 million by the end of 2018 – and now residents are left paying more per month to make up for it. Georgetown residents lost about $30 million over four years, and the town’s citizens were receiving energy bills for an average of $600 more than neighboring towns.”

2) Massive Solar Plant failures: either closed or not producing near the promoted energy.

1) Crescent Dunes $1 billion (5th largest)

2) Ivanpah: $2.2 billion (3rd largest)

If you like extravagant benefits for unqualified, do-nothing fat cats, then you will love the OC Power Authority. Tomorrow on the surprise OCPA board meeting agenda – the most offensive example of government self-dealing I have ever seen.

– Insane, over-the-top employment policy with extra luxe benefits for “C-level” executives. Includes 49 PAID DAYS OFF or almost 2.5 MONTHS off/yr for executives, $500/month auto stipend for C-level execs, even ones who don’t know what a kWh is (see https://irvinewatchdog.org/2021/07/20/oc-power-authority-ceo-brian-probolsky-has-no-experience-or-education-drawing-major-concerns/ for more on Brian Probolsky’s lack of qualifications).

– adding unincorporated OC to the OCPA implementation plan. The plan includes a 10-year financial analysis that “Assumes no OCPA rate discount,” which means that ratepayers (who will all be opted in) will not be saving any $ w OCPA. It’s on page 30 of the implementation plan – see the small print at the bottom of the table.

Board meeting is tomorrow 12/21 at 9am. Zoom link and agenda are here – https://www.ocpower.org/wp-content/uploads/2021/12/December-21-2021-Special-Board-Agenda.pdf

Hi, I am a graduate student currently writing a research paper on the relationship between our military and the energy debate. Your articles and recent interview with Epoch have been illuminating. Do you have any suggestions/angles/research that might help me argue why energy freedom is so important to our military? The news about green energy has been horrendously deceitful. Thanks for shedding light on such an important issue. In my estimation if we get energy wrong it may be one of the defining moments for America and our way of life over the course of the century. Do you have any ideas on how I can bring the consequences of CCA’s (E’s) to bear on our defense forces?

Hi George. I’m a simple thinker. Green, or renewable energy is provably more expensive and less reliable than fossil fuels. The only reason they are being forced on the world is through ideology, propaganda and the public’s compliance and fear. Without these artificial arguments reliability, safety, environmental concerns and cost would drive all energy conversations…in that order. In military concerns these elements would juggle slightly but reliability would still be at the top. Our enemies constantly gauge our war making potential, how do you think they view our military’s adoption of renewables? less reliability = less safety for America. Why would this be? my strongest feeling is that America’s enemies are in control of her, the weaker the country the more successful their plans become. Once we connect the dots I believe that answer is inescapable.

I hope that little bit helps. If you need more data or ideas please email me at mikehosk@me.com

Thanks, Mike

Proof of concept…does this make us stronger of weaker ? https://www.dailywire.com/news/america-first-diplomacy-is-over-biden-tells-g-7-summit